HPIL Holding (OTC:HPIL)

I won't be updating this, if you are retarded enough to get suckered again, you deserve the outcome.

Who doesn't love a good perpetual motion electric vehicle scam? Honestly? That is in fact what drove most investors to HPIL Holding in the summer of 2021. Electric vehicles were HOT in the stock market and Lord Ferrox Tutinean was itching to find some idiot to give him money for an electric vehicle that never needs external power. The Apogee self-charging drivetrain was to eliminate the need to charge the EV via plug, rather the drivetrain (based on the completely made up "Law of Unbounded Charging") would charge itself in motion... or in other words, magic beans. Still no prototype, shocker... inventor gone. Bye bye LT!

Paired with a perpetual motion scam was an entire portfolio of one page webpages announcing huge innovations or perfectly timed product releases to different technology sector hot markets. HOW COULD HPIL HOLDING MISS!?!? Well... it is all a fraud. NFT's were fake, partnerships were fake, product launches were fake, buybacks were fake, fakety fake fake fake.

Instead of a buyback, there was massive toxic loans and 3a10's issuing billions of shares. Instead of funding, there was no money other than to fight MASSIVE undisclosed lawsuits. Filings? Fraudulently Hiding everything wrong with the company. David Postula money raising hitman. The three dumb-megos.

"fiction" - Riz Alikhan, Senior Vice President of Business Development and Operations for Europe

Who Ruined HPIL?

HPIL shareholders have no damages from anyone other than Stephen Brown, the toxic lenders (GPL, Auctus, etc), and the TA Olde Monmouth. The reality is, without Stephen Brown's fraud, shareholders would have never been hurt. This is well documented in filings, court documents, share issuances, and actions by Stephen Brown (such as releasing fraudulent press releases to pump the stock). By the actions and failures of Stephen Brown, HPIL shareholders were harmed the most. His need to defraud led to multiple regulatory agencies taking action against HPIL for violations of basic regulations, as well as CRKM his other pubco. A summary:

-

FINRA decided HPIL could not undergo any corp events because of the (still ongoing) filing delinquencies Brown had 1.5 year to fix and didn't.

-

BCSC decided that, due to audited financials not bring filed per the law (still not filed), it could not be traded by Canadians (same with CRKM) and slapped a Cease Trading Order (CTO) on HPIL (and CRKM).

-

OTC Markets decided the filings were so suspect, that it placed a "buyer beware" CE in the stock, no longer allowing US citizens to trade HPIL stock.

-

SEC and OTC (months later) then decided the control dispute (after review) was real enough that HPIL was placed on Expert Market until it could be sorted out in court.

-

SEC has now decided that unless CRKM files audited financials within weeks, it will likely have its securities (shares) revoked in 2023.

-

All of these actions were taken by regulators and authorities based on Stephen Brown's actions. The law is the law. The regulations are black and white. FINRA, SEC, OTC, and BCSC all made these decisions based on public facts and filings made/not made by Stephen Brown.

-

On top of that, multiple judges in multiple provinces/territories/states have ruled based on the known facts, that Stephen Brown either lied, cheated, stole, embezzled, defrauded, etc. tens of folks over the past few years for well over $10M.

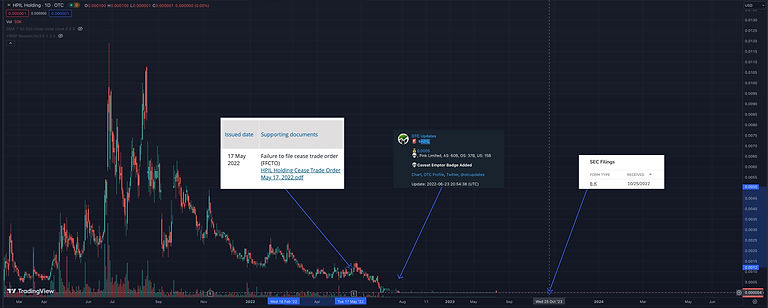

By the actions and failures of Stephen Brown, HPIL shareholders were harmed the most. You can see from overlaying these events over the HPIL shares price, that HPIL was already trading well below the retail minimum bid price of .0001 (because retail could no longer trade it) at .000004. It'd had been to that share price, for a FULL 2 MONTHS! The the 8k did nothing to damage HPIL shareholders, who had already lost everything due to Stephen Brown's actions alone.

BuT tHE toXIc NotEHOlDErs!!! Oh, you mean Stephen Brown's toxic notes, the ones he took out just weeks after taking control (he admitted to in a federal lawsuit : Case Number: 1:2022cv02959)? The toxic notes he left off the filings and lied to shareholders saying he put his own money in? Yup, that is right. If you look at the largest conversions for the largest $ amounts after he took over, these were not "old notes" (as Stevie lied to shareholders about). These where STEPHEN BROWN'S notes, that STEPHEN BROWN took out, with the lowest conversion prices the stock had ever seen through GPL Ventures; and ALLOWED them to convert well before the minimum 1-2 years holding period. Stephen Brown admitted to it in federal court, this is not a debate. Here is a view of the timing of the notes Stephen Brown took out and the shares issued vs the stock price.

HPIL is in default for over $2M in debt Stephen Brown took out, not a penny has been payed and there is no way for them to convert into shares and sell to get their money back. That means HPIL shareholders have a net negative book valuation causes solely by Stevie's actions. No assets, >$2.5M in liabilities and growing.

What about "the company and projects!?" Well, that has all but been abandoned. Self proclaimed "Business Associates" are very close to Stephen Brown and at the time of the 8k they had already been in conversation discussing the removal and abandonment of all HPIL assets. Stephen, Mark, Darcy, Ryan, Andy, etc all were well aware of this prior to the 8k being filed. This is documented on numerous emails and other written communication. There does not exist any HPIL projects anymore:

-

zippa.gg ABANDONED

-

nftprocurement.com ABANDONED

-

worldgaminggroup.com ABANDONED

-

medusaintelligence.com ABANDONED

-

hummtoken.com ABANDONED

-

theapogeed7.com ABANDONED

-

getsanta.gg ABANDONED

-

solomonsrevenge.com ABANDONED

-

apogeedynamics.com ABANDONED (there is nothing there, still)

-

etc.

HPIL Holding has now been renamed to EV World Holdings, indicating a EV only focus. But the catch is, there is nothing in it. The other catch is... this means that HPIL can NEVER get trading again because, as Stephen Brown found out with the Cybernetics name change, FINRA will not process it. Meaning, Stephen Brown took a direct corporate action he knows will keep HPIL from ever being traded. The damage to shareholders is WORSE than the 8k being claimed by a few folks as damaging shareholders.

Why is Stephen Brown claiming to. have put money in, when filings say he hasn't!?

-

"I am putting that money in personally and that's what I'm doing and that's my commitment" https://youtu.be/9dlWAX-GxsE?t=636

-

"There is money I put in, but that is not really debt..." https://youtu.be/9dlWAX-GxsE?t=3065

-

"I'm putting my money behind it" https://youtu.be/LZ_VXKkalyc?t=906

-

"I put my own money into this company" https://youtu.be/LZ_VXKkalyc?t=1175

-

"put my money where my mouth is" https://youtu.be/LZ_VXKkalyc?t=1903

-

"I'm putting my money in..." https://youtu.be/LZ_VXKkalyc?t=1918

-

"I put money in... I've put in money, an excess of $600k" https://youtu.be/J1LOCS8qcjQ?t=405

-

"that's why I'm putting my money in" https://youtu.be/J1LOCS8qcjQ?t=2236

-

"my money in" https://youtu.be/sm8gdKJEIvk?t=92

-

"I have my own money in there" https://youtu.be/FnRhnUMKVQc?t=211

-

"I put my own money in" https://youtu.be/wL43NezlLSQ?t=580

-

"I put in a lot of money" https://youtu.be/04QvxmJrC3U?t=343

-

"I put my own money where my mouth is" https://youtu.be/04QvxmJrC3U?t=374

-

"all I have is commitment and money in the game" https://youtu.be/04QvxmJrC3U?t=686

-

"putting in my own money" https://youtu.be/04QvxmJrC3U?t=791

-

"7, 8, 9 hundred thousand dollars into the company" https://youtu.be/uNqC66U-ZsE?t=521

-

"I have invested my cash over $1 Million dollars..."

006

FRAUD: There Was No Official Partnership With Origin

Origin Protocol denies a partnership with HIPL Holdings in their AMA here: Origin Protocol Twitter Spaces AMA - July 6th 2021

008

FRAUD: FINRA Never Approved Namechange

Stephen Brown announced a fraudulent name change approval the same day he filed for the name change with FINRA per the FORM 8-K filed by HPIL Holding CEO. The name change was later reversed as HPIL could not provide the necessary paperwork to satisfy FINRA.

011

FRAUD: GAMEZCASH and TUNEZCASH Do Not Exist

No asset "acquisition." TUNEZCASH was renamed HUMMTOKEN and announced as "another" acquisition "to be developed."

016

FRAUD: Never Had Technology or Licenses to Launch NFT's

Stephen Brown never had approval or licenses necessary to launch said NFT's. NFTProcurement.com has been taken down.

024

FRAUD: There Was No Credit Line

An Equity "Credit Line" is not a credit line, as stated by HPIL lawyers, The Basile Law Firm, it is just another form of cash for discounted shares scheme.

038

FRAUD: Fake Acquisitions

Criminally negligent on details required for a publicly traded company. Each one of these need to be in the disclosures, in detail, during the reporting period the acquisition happened. Most are just ideas "acquired" from Stephen Brown that he then gave shares to himself for.

041

FRAUD: Conflicting Calculations

The company filings created and published on OTCMarkets in parallel to this lawsuit claim the convertible notes at .00001 are under the 25% interest rate claimed by the lawsuit.

???

FRAUD: How Many More?

This page will be continually updated with as many as we have confirmed and have time to add them...